Library

Open as PDF

Market Information and Regulation

Trading Rules (Equities) Trading Rules (Bonds) Margin Transactions Rules (Japanese) X-Market Participation Rules X-Market Information U-Market Information Self-Trade Prevention 2.00 Short Selling Rules 2.00 Fee Schedule Client Connectivity Testing Schedule Market Events SchedulePolicy

Personal Information Protection Declaration Best Execution Policy Solicitation Policy (Japanese) Basic Policy for Antisocial Forces (Japanese) Conflict of Interest Policy (Japanese) Business Directive on Fiduciary Duty to Client (Japanese) Basic Approach to Information SecurityTechnical Specifications

SoupBinTCP Specification 1.00 MoldUDP64 Specification 1.00Equities

FIX Trading Specification Equities 3.00 OUCH Equities 1.12 Sample PCAP File OUCH Trading Specification Equities 2.00 FIX Drop Copy Specification Equities 2.01 ITCH Equities 1.7 Sample TCP PCAP File ITCH Equities 1.7 Sample UDP PCAP File ITCH Market Data Specification Equities 2.00 GLIMPSE Equities 1.4 Sample PCAP File GLIMPSE Market Data Specification Equities 2.00 Data File Formats 2.00 Market Access Control User Manual 3.00Bonds

FIX Trading Specification Bonds 2.00 OUCH Trading Specification Bonds 2.00 FIX Drop Copy Specification Bonds 2.01 ITCH Market Data Specification Bonds 2.00 GLIMPSE Market Data Specification Bonds 2.00Holiday Calendar

Japannext PTS is open five days a week from Monday to Friday except for national, observed, and exchange holidays. Please refer to the tables below for exact dates.

Proven Technology

Our PTS Technology

Japannext PTS continuously invests in the optimization of its technology and infrastructure to ensure the growth and reliability of its service over the entire trade lifecycle. This ensures that Japannext PTS remains on the cutting edge when it comes to trading securities in the Japanese market.

We have partnered with NASDAQ to successfully launch a new NASDAQ powered trading system on September 26, 2011. By shifting to NASDAQ's extensively proven exchange technology, our members benefit from significant latency improvements and increase in throughput capacity. This system shift will enable us to offer our customers an advanced, low-latency trading system in line with international standards. High-performance trading technology is a vehicle for growth, and Japannext PTS maintains a prime position to further increase our market share and customer-base.

Other peripheral technologies such as a FIX order entry gateway and various market data feeds were developed internally to ensure high performance and low latency characteristics on par with, if not better than, the best exchanges in the US. Our market participants can rely on us to go to great lengths to ensure the redundancy and reliability of our services.

We offer market data information and accept clients' orders via emerging industry standard protocols OUCH and ITCH. These protocols open up a fast and extremely efficient way to engage with our market. We also support the industry standard FIX protocol.

Besides underlying technology strength, we also strive to improve the business experience of our clients. Today Japannext PTS is the only PTS operator which offers its services during both day and night. Our daytime and nighttime markets are always steps ahead of primary exchanges due to their competitive tick sizes and that our nighttime market takes advantage of the next day's referential prices, day limits, and tradable security list. For quality trades, during daytime market hours all eligible participants may place their orders to the daytime's sister market (X-Market) where they will be guaranteed to cross only with certain retail flows.

Our Offerings

Co-Location Racks

Designed specifically to meet the demands of the financial Industry, our co-location space provides the lowest latency to the Japannext PTS matching engine, as well as one of the lowest latencies to the other Japan venues. We are able to provide our clients a cost effective, flexible installation, and fully monitored service .

Remote Hands Support

We provide full remote hands service to our members for our PTS racks and any other data centers located in Japan. We have multilingual staff on-site and on duty 24/7, dedicated to providing support and troubleshooting issues. We pride ourselves in our quick response times and comprehensive assistance.

Hardware Purchasing

For international clients concerned about warranties or local pricing of hardware, we are able to provide our clients with the option to purchase their hardware. All devices are fully covered under Japanese warranty and we have secured competitive pricing . Please reach out to our sales team for more information.

Historical Market Data

We provide our members and their potential trading clients to access our historical tick market data for their analysis.

Multilingual Support team

We understand the importance of having a team that can support our global clients. We have a multi lingual team that is able to cater to your needs

PTS Features

Trading Hours

- Daytime market: 08:20 – 16:30 JST

- Nighttime market: 17:00 – 6:00 JST

X-Market and U-Market are available during daytime market hours.

Trading Days

- Same trading days as the primary exchange.

Order Driven Markets

- Continuous matching based on price-time priority.

- No pre-open and close auctions.

- Supported order types:

- Limit

- IOC (Immediate or Cancel)

- FOK (Fill or Kill)

- Short Sell and Short Sell Exempt

The main PTS market is split into two sessions, refered to as the Daytime Market and Nighttime Market. For more details please refer to Japannext PTS Trading Rules.

The X-Market is a targeted market which sets its focus on retail clients. It has an additional matching rule which prevents crossing between DLPs (Designated Liquidity Providers). This combined with the qualification procedure for buy and sell sides creates an unique opportunity for DLPs to improve prices. For more details please refer to X-Market Information and X-Market Participation Rules.

The U-Market is designed to facilitate Index Arbitrage traders interacting with DLPs, with greater flexibility of price ranges and tick sizes. For more details please refer to U-Market Information.

Exchange Tick Size Comparison

| Price | Tick Size | ||||

|---|---|---|---|---|---|

| Above | Up To |

Other than TPX100 and TopixMid400

(JNX J-MKT)

|

TPX100 and TopixMid400

(JNX J-MKT)

|

Other than TPX100 and TopixMid400

(TSE)

|

TPX100 and TopixMid400

(TSE)

|

| 1,000 | 0.1 | 0.1 | 1 | 0.1 | |

| 1,000 | 3,000 | 0.1 | 0.1 | 1 | 0.5 |

| 3,000 | 5,000 | 0.5 | 0.1 | 5 | 1 |

| 5,000 | 10,000 | 1 | 0.1 | 10 | 1 |

| 10,000 | 30,000 | 1 | 0.5 | 10 | 5 |

| 30,000 | 50,000 | 5 | 1 | 50 | 10 |

| 50,000 | 100,000 | 10 | 1 | 100 | 10 |

| 100,000 | 300,000 | 10 | 5 | 100 | 50 |

| 300,000 | 500,000 | 50 | 10 | 500 | 100 |

| 500,000 | 1,000,000 | 100 | 10 | 1,000 | 100 |

| 1,000,000 | 3,000,000 | 100 | 100 | 1,000 | 500 |

| 3,000,000 | 5,000,000 | 100 | 100 | 5,000 | 1,000 |

| 5,000,000 | 10,000,000 | 100 | 100 | 10,000 | 1,000 |

| 10,000,000 | 30,000,000 | 100 | 100 | 10,000 | 5,000 |

| 30,000,000 | 50,000,000 | 100 | 100 | 50,000 | 10,000 |

| 50,000,000 | 100 | 100 | 100,000 | 10,000 | |

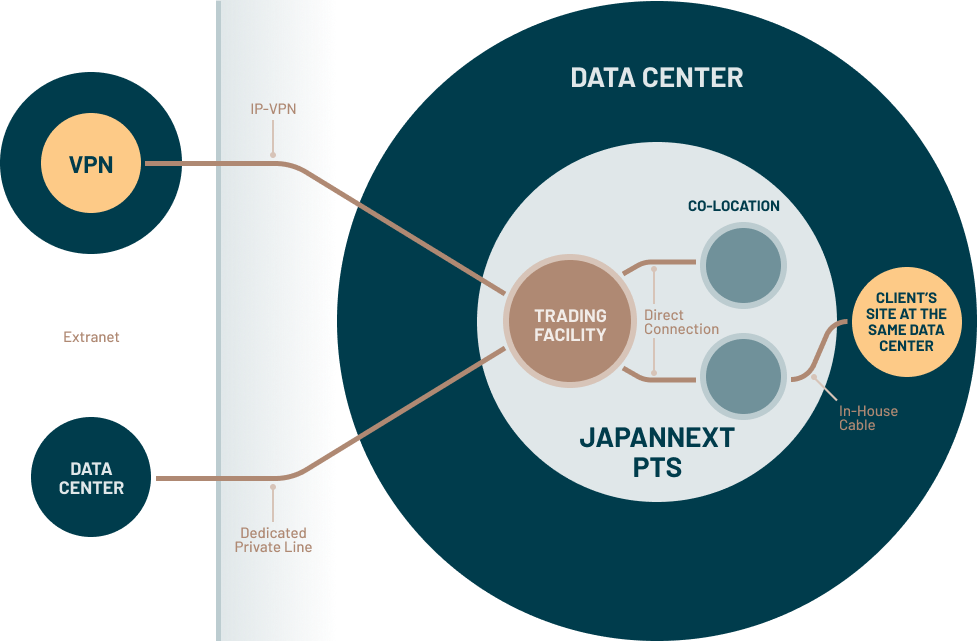

Extranet Options

- Depending on latency requirements, clients can select either IP-VPN or private line service.

- As part of the managed service, Japannext PTS:

- Leases, installs, and manages lines commissioned by service providers.

- Installs and manages routers in clients’ datacenters.

- Monitors, alerts, and fixes any issues with lines and routers.

Co-Location Options

- Clients can install and manage network infrastructure in Japannext PTS co-location racks allocated to them.

- Clients can establish:

- In-house cross connects to other venues.

- External connections to required destinations.

- Local inter-rack cross connects.

- Clients with presence at the same datacenter can establish in-house cross connectivity via a co-location half/full rack space.

- Clients gain ultra fast access to the Japannext PTS matching engine.

- Co-location rack comes with:

- 10 Gbit / 1 Gbit optical SM fiber or 1 Gbit UTP connection.

- 100 or 200 V (2.1 kVA) standard power supply.

General Connectivity Diagram

JAPANNEXT DATA CENTER

Japannext provide network connectivity for participants to access Japannext PTS markets.

Telecom WAN circuits and colocation spaces are supported for the connectivity.

-

Telecom WAN Circuit

Enable participants in different data centers to access Japannext PTS. -

Colocation Rack

Clients can install servers and access Japannext PTS with lower latancy

Directly from Japannext PTS

- Native protocol

- RDFD (Refinitiv)

- ActivFeed (Activ Financial)

Please click here to see latest data providers.

For Market Data Vendors and Direct Feed Subscribers

Full market depth information.

For Terminal Users

- Level 1

- The best bid and ask price quotes and all derived information including turnover and OHLC (Open High Low Close).

- Level 2

- Full market depth information.

Fat Finger Limits

- Maximum Quantity

- Per order quantity is up to 5% of the total number of outstanding shares listed at the exchanges. An order with a quantity exceeding this limit will be rejected by Japannext PTS.

- Maximum Value

- The standard order value limit is 100 million JPY per single order. An order with a value exceeding this limit will be rejected by Japannext PTS. The 100 million JPY limit can be extended to 2.5 billion JPY by using the special order confirmation flag in an order message.

- Price Range

- The limit price of an order should be within the price range specified by Japannext PTS. If the limit price is outside this range, then the order will be rejected by Japannext PTS. Newly listed stocks without an initial share price on the primary exchange can not be traded on Japannext PTS.

Value Added Options

- Drop Copy

- This service is designed to deliver real-time information about activity taking place at Japannext PTS and can be configured to send a message any time an order is entered, canceled, or executed – or any combination of these events. The service can be integrated for straight through processing into a participant’s risk management and settlement systems.

- Cancel on Disconnect

- For any participant’s FIX order entry port, the cancel on disconnect feature may be activated by request. Once enabled, all open orders created over the FIX session being disconnected due to any reason, will be automatically canceled. For every canceled order, an unsolicited cancellation message will be sent to the participant upon connection re-establishment.

OUCH order entry ports have this feature permanently turned on. - Market Access Control

- This service allows users to suspend trading activity on their order entry ports under emergency situations. Upon suspension all open orders will be automatically eliminated and the trading system will start to reject new orders. Users can choose between a web based interface or programmable API.

Clearing

All trades on Japannext PTS are cleared through JSCC (Japan Securities Clearing Corporation). The benefits are guaranteed settlement on PTS trades (no counterparty risk) and straight through processing for trade settlement.

Settlement

All settlement processing is done through JASDEC (Japan Securities Depository Center). Requirements include MIC (Market Identification Code) for JASDEC PSMS (Pre-Settlement Matching System) and reconciliation processing completion.